What are 5 questions you should find out before you select an insurance?

9/25/23 Ricksinsuranceplans.com

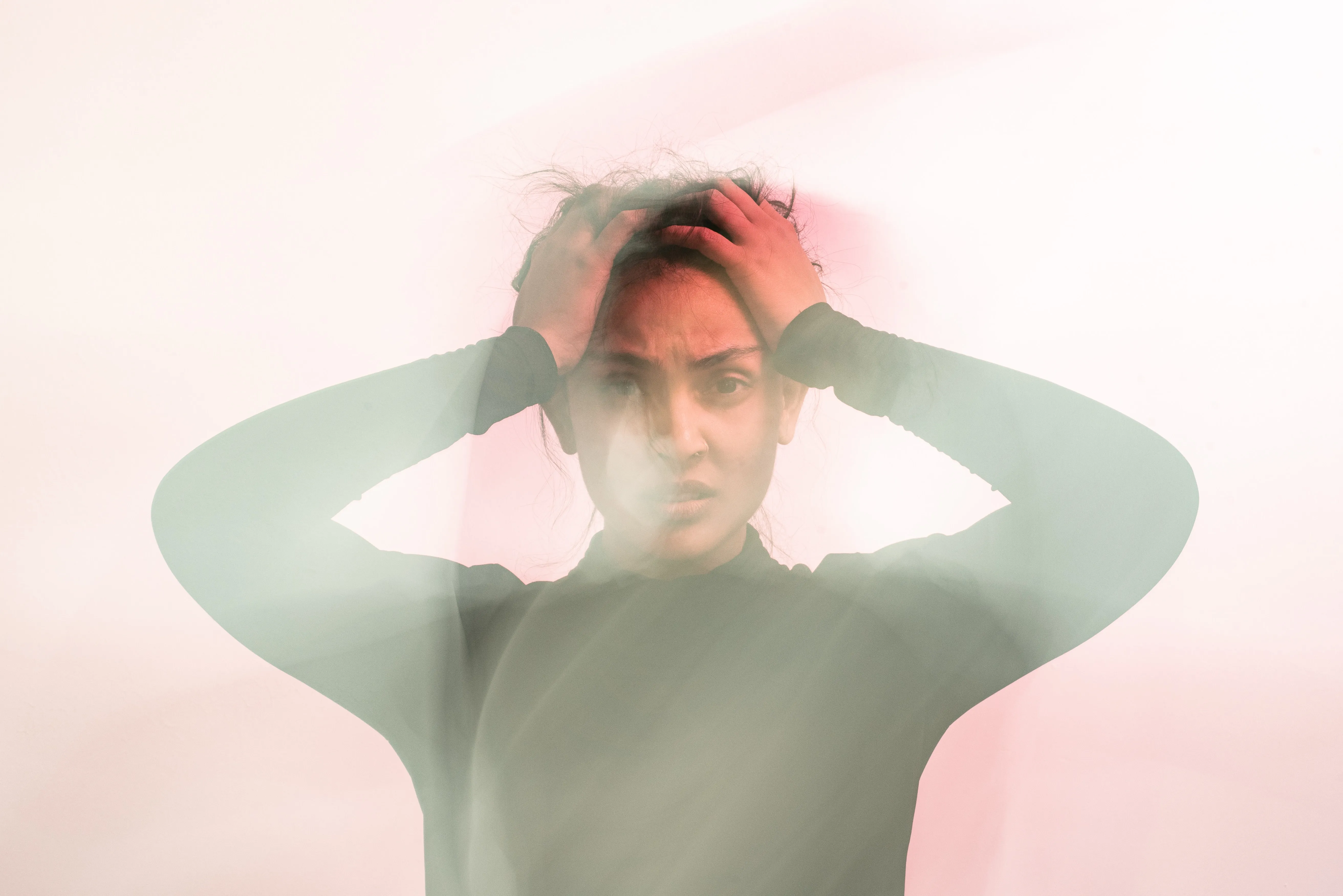

In today's world, insurance can be a complex and intimidating process. With so many options to choose from, it can be hard to know which insurance plan is right for you.

In this blog post, we'll be uncovering the right insurance plan so you can make an informed decision and get the coverage you need. We'll discuss the types of plans available, what to look for when comparing policies, and tips to help you save money on your insurance.

What is the Size of the Coverage Network?

When shopping for a health insurance plan, one of the most important things to consider is the size and scope of the coverage network. A comprehensive plan will have a large pool of doctors, hospitals, and other medical professionals in its network that are covered by your insurance.

Understanding how big this coverage network is can give you an idea of the kind of care you'll receive from your chosen health insurance company.

In general, most networks provide access to thousands of physicians in nearly any specialty or sub-specialty area. Additionally, larger plans may include top national healthcare providers such as Anthem or Ambetter.

Some plans may also offer access to international clinics if medically necessary care isn't available at home. To get an exact understanding for what’s available with each plan, it's best to thoroughly research each provider’s website before making a decision on what type of coverage works best for you.

After researching whether a specific doctor or hospital is part of your chosen plan's network, many people wonder about out-of-network services if they need them later down the line when emergencies arise or other special needs come up that aren't currently provided by their chosen provider team?

Generally speaking, seeing an out-of-network physician requires advance authorization and there’s usually no guarantee that your request will be approved – therefore having full details regarding these kinds payments terms prior signing up should be carefully studied so as not to incur financial surprises later.

The cost associated with using out-of-network providers varies from insurer to insurer but typically includes higher copays/deductibles than those seen with in–network visits; however sometimes insurers waive certain costs depending on individual need situations.

– such instances should be clarified beforehand nonetheless

-

it would be wise double check all applicable fees before making any decisions during enrollment period.

Knowing exactly which doctors and hospitals are covered under a particular policy can save customers a lot both financially and time wise when selecting healthcare options. Hence, careful consideration prior enrolling within a given option should always taken into account in order make sure everyone’s needs are met.

While concurrently exploring different existing alternatives alongside price points & deductible structures etc…so desired outcome achieved without surprise charges afterwards!

What Type of Network Does the Plan Offer?

Finding out how big the coverage network is of a health plan, and what kind of network it is, can be important when deciding which health plan to choose.

Different networks have different costs associated with them. You'll want to know the size of the network and whether your current doctor is covered by it (is in-network) so you can make an informed decision about which option will be best for you financially as well as medically.

When looking at a health plan, check if they list their coverage area on their website or other marketing material – that way you’ll get an idea of how vast or restricted their network might be.

Knowing what type of network it is helps too; HMOs tend to have smaller networks than PPOs but provide more comprehensive care within those confines.

Once you've identified if your current doctor is in the provider's network (in-network, then ask yourself two questions:

How much will I pay if I see a doctor who isn't included in this specific insurance plan?

And do I expect to receive any out-of-network care while insured under this particular policy?

Understanding these answers beforehand can save you time and money later on down the road should something unexpected come up regarding your healthcare needs or plans.

Out-of -Network charges are usually higher than those incurred from seeing providers within the specified provider's range--meaning less money back from your insurer after submitting a claim form for services rendered outside its scope.

Still, many times going "out" may still prove cheaper than staying inside particular networks due to high premiums required membership fees assigned by certain providers / insurers etc.

It all depends upon individual circumstances and preferences -- making sure that researching ahead pays off!

Whether opting for traditional forms of insurance or taking advantage newer alternative options such as telemedicine/virtual visits—it’s always beneficial to understand all viable cost saving strategies available before heading into unknown waters ,so weighing one’s options carefully upfront speeds up future reimbursement processes down he line.

With better preparedness comes greater peace mind–allowing individuals remain focused on attaining optimal levels physical mental wellness rather than worrying over paperwork related matters brought about unexpected illnesses treatments.

Is Your Current Doctor Covered by the Plan?

The size of the plan's coverage network can be a major factor in determining whether or not your current doctor is covered by it.

Knowing how large the plan's network is before you sign up for it can help you make an informed decision about which provider to select. By understanding the size and scope of a plan’s network, you can determine if your current doctor will be included in its coverage. Knowing this information ahead of time allows you to easily choose a plan that meets all of your needs and budget.

Many insurance companies offer different types of networks to their customers, such as HMOs, PPOs, EPOs, and other variations on these models.

It’s important to know what kind of network is associated with any given health insurance plan so that you understand how much choice or flexibility you have when selecting providers within it.

Additionally, some plans may limit provider options based on certain criteria like location or specialty type-so knowing what type of network is available with each potential insurer can help narrow down your selection process even more quickly.

If your current doctor isn’t covered by this particular health insurance plan then there are two main things to consider—whether they accept out-of-network payments from whoever provides the health care services and how much they charge for them separately from any provider discounts negotiated through affiliated insurers versus being paid directly out-of-pocket.

Additionally, many doctors now offer telemedicine services which could provide another convenient way for patients who need access to specific specialists but who don't necessarily live nearby those offices anymore!

Out-of-network care usually costs more than seeing someone who accepts payment from whichever insurer pays for services within that same policy depending on its terms; however prices often still vary greatly between individual medical professionals regardless.

To avoid surprise bills at later stages during treatment , meeting with prospective healthcare providers upfront - either by phone call or physical visit -for pricing clarification should always be done before making a final decision about where best receive treatments necessary*

For people seeking medical assistance outside their own preferred doctors list , no matter if insured/uninsured regulatory entities maintain databases open under freedom Information Acts offering details regarding availability local clinics ( regular service + COVID related , free / low cost overall fee medical centers & hospitals accepting walk ins besides appointment scheduling ; plus special attention given members military service personnel & veterans retired*.

What Will You Pay for Out-of-Network Care?

When choosing a health care plan, it is important to know how big the coverage network for the plan is.

Finding out what kind of network structure your plan has will help you determine if there are any restrictions on where you can get medical treatment and from who Is the provider in-network?

Are all hospitals or medical facilities available with this plan?

Will I need to switch doctors if I get this particular plan?

Knowing the size of your health care providers' network and its offerings will ensure that you have access to quality care at an affordable rate.

Not all networks are created equal; some may be extensive while others limited in coverage locations and services offered with them. If you currently have a doctor whom you prefer then it’s important to research their availability within the new network before committing to it so that your preferred physician isn't excluded from being visited due to lack of affiliation with certain plans.

For instance, most managed care systems require treatment by specific specialists or clinics affiliated with their networks only; meaning that even if your current doctor is not part of this new system for whatever reason, they could still provide service outside of the preferred provider organization (PPO).

The cost associated with out-of-network visits can vary widely depending on which type of insurance policy is chosen as well as any extra costs associated with non-covered items such as co pays and deductibles etc.

It’s important for every consumer researching a health insurance policy option should consider these added expenses when deciding whether a policy suits their needs best.

In addition, keep in mind that some insurers offer discounts on out-of-network services through preapproved arrangements so it pays off for consumers who take time look into these options too!

When evaluating an existing or potential healthcare insurance plan ask yourself how much money would be spent seeking treatment from physicians outside one's network--this includes prescriptions or specialty services not covered under traditional plans (eg, complementary medicine).

Many policies include "outlier provisions" which limit payments made toward anything deemed 'unnecessary', so check up on expected costs here too before signing any contracts!

Lastly, individuals should also consider their own preferences when determining whether they ought to seek outcare from an in--or--out --of -network doctor.

Questions like ‘Will visiting this specialist require additional commuting time?'

or 'Do my conditions warrant seeing someone specialized beyond my primary physician?'

offer great insight into what kind of healthcare arrangement best fits individual lifestyles. Understanding oneself better means being proactive in making useful decision about one's own wellness journey !

Tips for Comparing Insurance Policies

When you're considering different insurance policies, one important thing to look at is the plan's coverage network. Understanding how big a policy’s network is can give you insight into what kind of services and care providers are included in your coverage.

You'll want to make sure you choose an option that gives you access to the care and services that are most important for your needs. Here's a place to look on social media.

How to Save Money on your Insurance Plan

How big is the plan's coverage network?

When you are evaluating an insurance plan, it is important to consider how large of a coverage network the plan has.

A larger network may offer more in-network providers and could mean that your preferred doctor or hospital is covered by this new insurance plan.

It’s worth researching all of the areas that are covered by your potential insurer to make sure you have access to medical care near where you live and can visit any specialist or emergency room if needed.

Take the time to ask these key questions before making any decisions so you know exactly what kind of coverage you’ll receive at the best possible price With a little bit of research, effort and dedication, you can save a lot of money on your insurance plan. Check out this broker site that has access to all the best available plans...iquote123.xyz

Plans for Missouri, Arkansas and Texas here. Outside these areas here. Other videos on the subject here in Youtube. And on Google.